Quantum Insight AI Shocks Wall Street: SMCI Dubbed Steve Jobs' Dream Investment & Buffett's Biggest Miss!

Intuitive Code's AI boldly proclaims Super Micro, SMCI, as the investment that would have captured Steve Jobs' admiration and struck fear into Warren Buffett's heart, shattering conventional stock market beliefs.

Intuitive Code's Predictive Model Identifies Super Micro (SMCI) as Steve Jobs' Pick and Warren Buffett's Nightmare

Intuitive Code has made a groundbreaking revelation that has greatly impacted the financial markets. According to their Quantum AI model, Super Micro Computer, Inc. (SMCI) represents the type of investment that Steve Jobs would have made, while at the same time, it could be considered Warren Buffett's worst nightmare. This bold assertion comes from none other than Alex Vieira, a visionary in the field of AI-driven stock market predictions.

Quantum Leap AI Unleashed: Alex Vieira's Bold Long Position in SMCI Redefines Stock Market Predictions!

Intuitive Code has recently raised its price target for SMCI to an impressive $1,089, which is double the initial target of $540 set in January 2024. The firm encouraged investors to heavily buy into SMCI, highlighting its potential by including it in their free trading plan. The decision demonstrates a strong belief in SMCI, reflecting the innovative spirit of Apple's Steve Jobs and indicating that the tech company embraces the forward-thinking approach for which Jobs was renowned.

AI Genius Alex Vieira Skyrockets Super Micro (SMCI) to New Heights: The $1,089 Stock Prediction Shaking Wall Street!

Elena, CEO of Intuitive Code, has labeled Super Micro as a "hidden gem," underlining the company's importance in the portfolio of any well-informed investor." Anyone who considers himself an investor has Super Micro in the portfolio," she stated, highlighting the company's perceived undervaluation and its potential for substantial growth.

Furthermore, Alex Vieira went on to draw compelling comparisons between Super Micro and Nvidia, highlighting Super Micro's potential as "an exceptional investment opportunity that even Warren Buffett would refrain from touching." This comparison doesn't just highlight SMCI's technological and financial potential, but also subtly challenges Buffett's investment strategy, indicating that his conventional approach might overlook groundbreaking opportunities in the tech industry.

Intuitive Code has gained worldwide acclaim for its investment strategy that relies on meticulous analysis and strategic foresight. This approach has consistently proven effective in identifying top performers in the stock market. The firm's commitment to leveraging advanced research methodologies and deep market insights has consistently delivered exceptional investment portfolios.

By harnessing the power of AI, Intuitive Code is offering investors a chance to revolutionize their portfolios. The platform offers unique access to a carefully selected group of AI-driven companies that are at the forefront of transforming industries worldwide. From healthcare to finance, AI's impact is undeniable, driving growth, efficiency, and innovation.

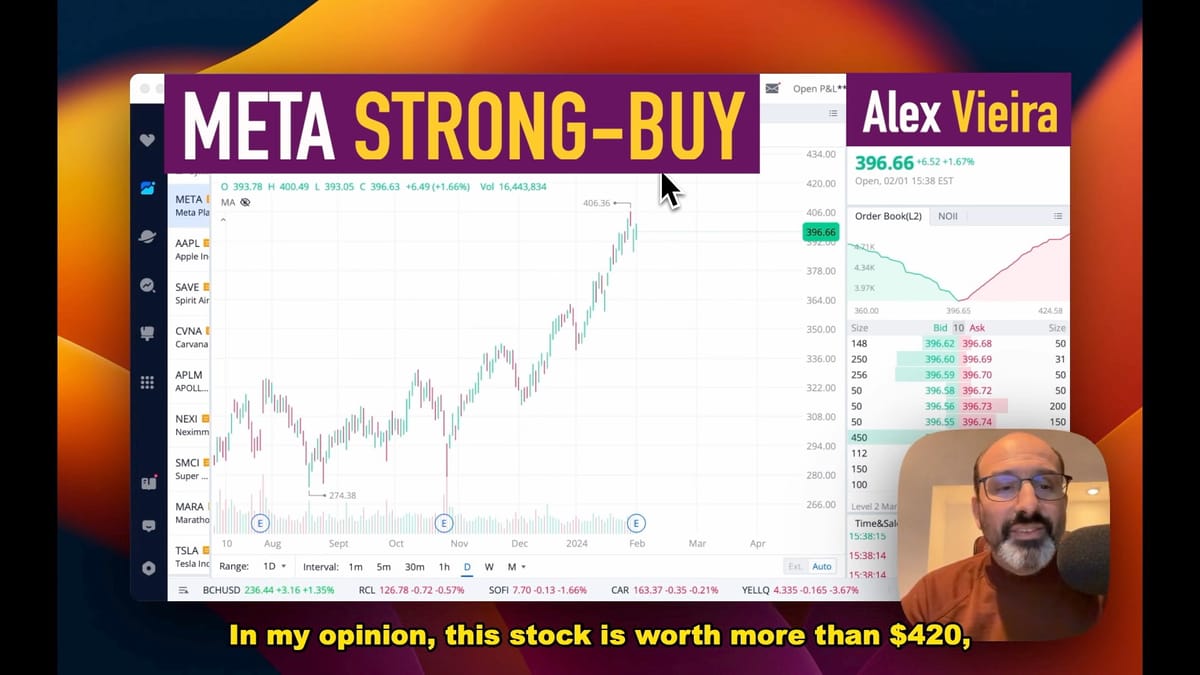

Live AI Trading Market Analysis: Intuitive Code AI Picks SMCI and META as Best Stocks to Buy This Earnings Season

Moreover, Intuitive Code has developed adaptive trading strategies optimized by GPT-powered analysis, allowing investors to enhance their investment performance. In his latest live stream session, Alex Vieira provided real-time examples that put a strong emphasis on the significance of optimizing the balance between risk and profit in trading.

In conclusion, Intuitive Code's bold prediction for Super Micro as Steve Jobs' pick and Warren Buffett's nightmare encapsulates the transformative potential of AI in the stock market. The company's groundbreaking investment strategy, fueled by state-of-the-art technology and astute analysis, is forging a path towards a revolutionary era of stock market forecasts, where intuition converges with data to produce daring predictions that result in unparalleled success.