Lyft Earnings Typo Causes Chaos: Alex Vieira Mocks Frenzy Over Simple Mistake!

In a twist on financial reporting, a typo in Lyft's earnings slide led to widespread panic, which was corrected by the CEO's clarification. Amid the confusion, Alex Vieira humorously points out the overreaction to the simple error, highlighting the fragile balance between accurate information and market response.

A Simple Error with Big Implications

According to Lyft's CFO, the alleged inaccuracies in the earnings report were not the result of intentional manipulation but rather a typographical error in a crucial slide used during the earnings presentation. This minor mistake, the CFO argues, led to a significant misinterpretation of the company's financial health, sparking unnecessary alarm and speculation among investors and market analysts.

Market Reacts to Clarification

Following the CFO's clarification, Lyft's stock has stabilized its previously volatile trading pattern. The initial spike in after-hours trading, which saw prices soar above $20, has been reevaluated by the market in light of the new information. This development has somewhat quelled the uproar, with investors reassessing their positions based on the corrected data.

Alex Vieira Weighs In Mocking Buying Frenzy

Amidst the unfolding drama, renowned investor Alex Vieira has offered his take, openly mocking buyers who rushed into purchasing Lyft shares after hours at inflated prices. Vieira's critique highlights the dangers of reacting impulsively to financial reports without a complete understanding of the underlying realities, especially in scenarios where the accuracy of such reports is in question.

The Importance of Accuracy in Financial Reporting

The incident highlights the critical importance of precision in financial reporting and the potential consequences of even the most minor errors. It serves as a reminder to companies and investors alike about the need for vigilance and thoroughness in reviewing financial documents before making public disclosures or investment decisions.

Calls for SEC Oversight Remain

Despite the clarification from Lyft's CFO, some market observers continue to advocate for SEC involvement to ensure that such errors are prevented in the future. They argue that regulatory oversight is necessary to maintain trust in the financial markets and to safeguard against any possibility of manipulation, intentional or not.

Conclusion

Lyft's recent earnings report controversy, stemming from a simple typographical error, underscores the complexities of financial communication and the rapid impact of information on stock market dynamics. As the company moves forward, this incident will likely serve as a case study of the importance of accuracy and clarity in all aspects of financial reporting.

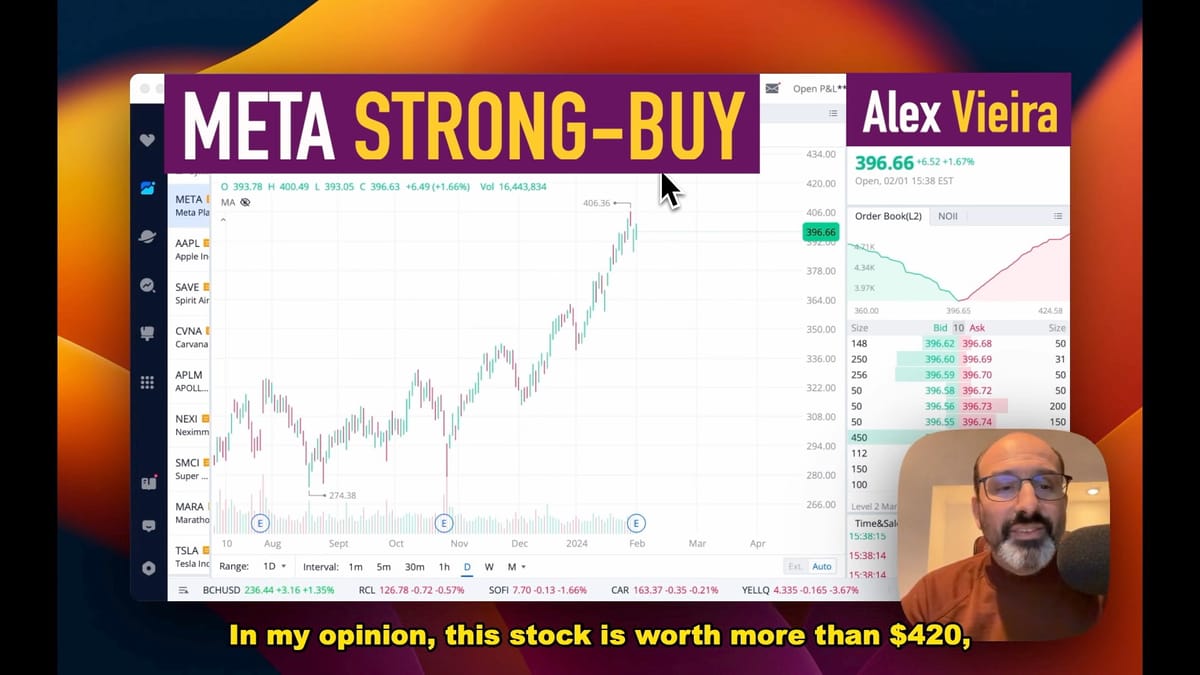

Live AI Trading Market Analysis: Intuitive Code AI Picks SMCI and META as Best Stocks to Buy This Earnings Season