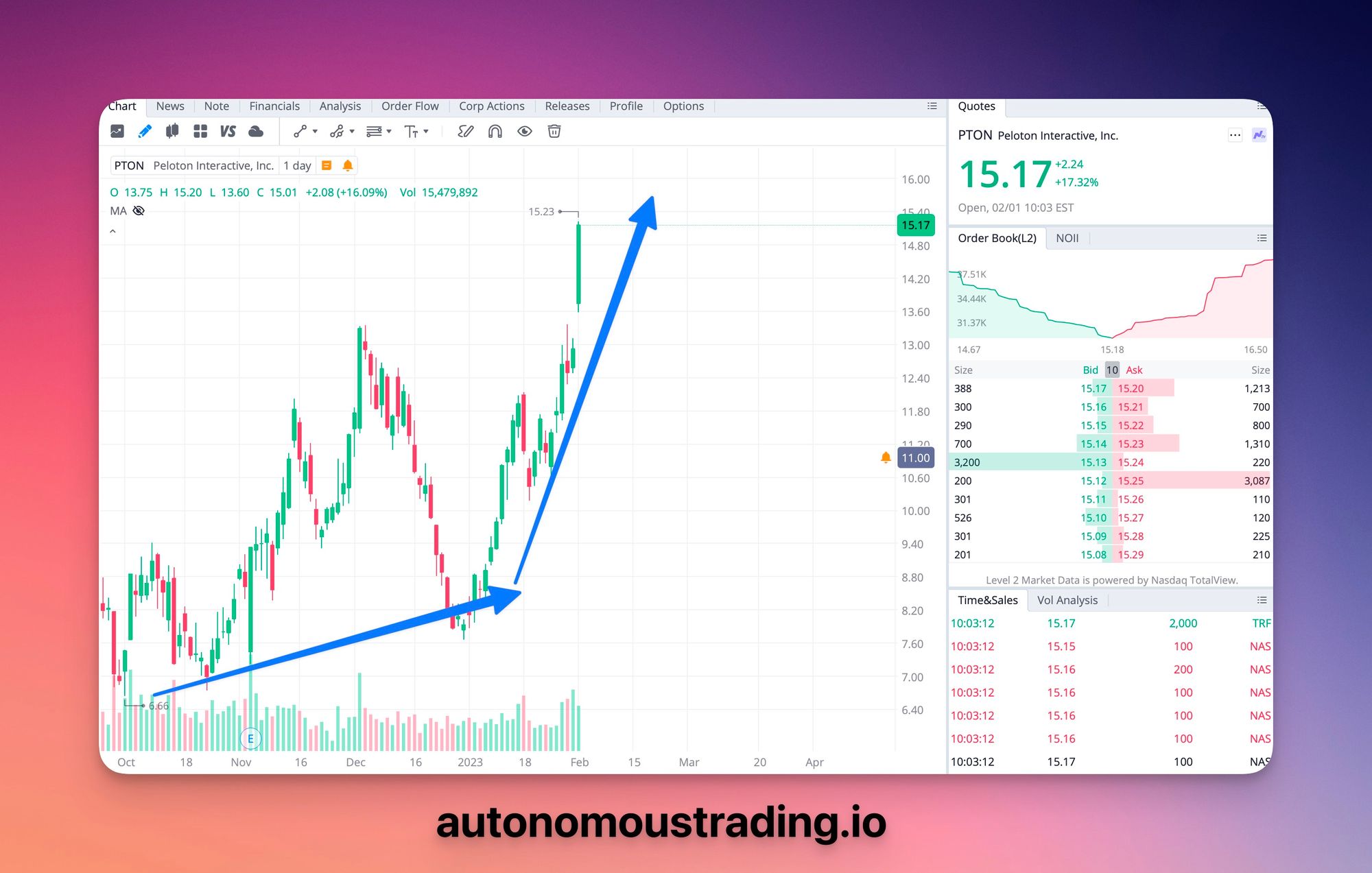

Intuitive Code Buys Peloton Doubling Price Target. Short-Sellers to Get Scorched by Trading Robots.

Use artificial intelligence algorithms and predictive analytics to outperform investing in Peloton's Interactive instead of biased Wall Street analysts downgrading stocks after they crash. Learn why you should buy Peloton's shares with the legend who called Peloton's crash from $160

Use artificial intelligence algorithms and predictive analytics to outperform investing in Peloton's Interactive instead of biased Wall Street analysts downgrading stocks after they crash. Learn why you should buy Peloton's shares with the legend who called Peloton's crash from $160

Disclosure: I have a long position in Peloton. I never made so much money on Peloton's stock crash.

Eager to learn about the investing team that called Peloton's stock crash from the top down to single digits? We have you covered.

Morgan Stanley Lowers Peloton Price Target to $4.5

We are no longer short Peloton. Instead, we bought shares in the first days of 2023, seeing Wall Street turning ultra-bearish.

Intuitive Code Doubles Peloton's Price Target

So, we amassed an investing position in Peloton in the first days of 2023, doubling its price target. From now on, we recommend that retail investors buy more shares in case Peloton's share price declines to Morgan's Stanley price target of $4.5

Great Call @IntuitiveAICODE on Peloton, making a killing $PTON

— Alex Vieira (@realalexvieira) February 1, 2023

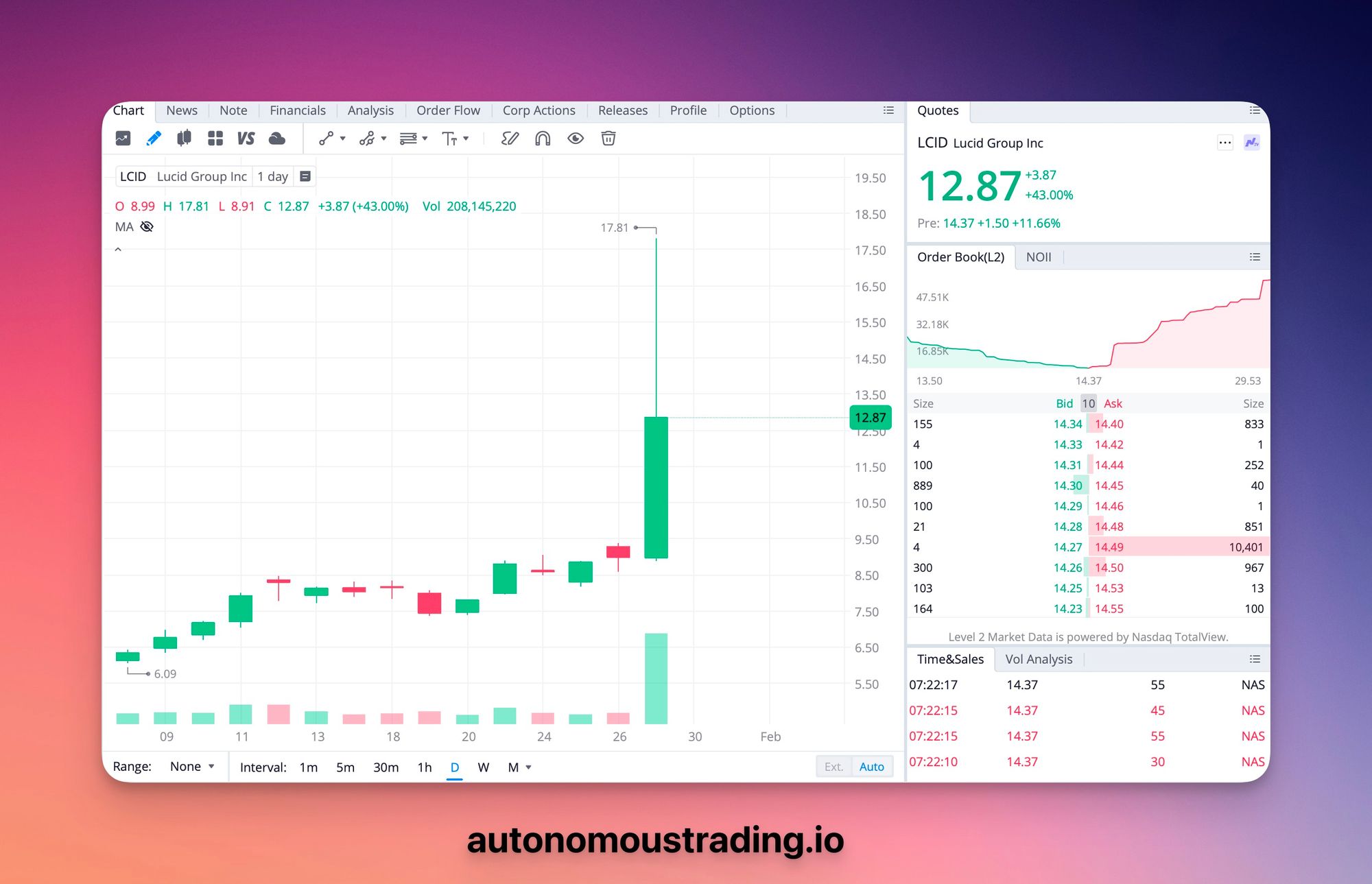

Are you looking for more opportunities where short-sellers get scorched in minutes by following Morgan Stanley's bearish outlook? We've you covered

We aim to accurately predict the price evolution of different assets like stocks, forex, commodities, and ETFs using algorithms and our expertise in numerous fields. Intuitive Code AI algorithms deliver up to 100% accurate real-time trading signals and highly accurate analytics for professional investors to outperform in the financial markets. Our expert insights include easy-to-use real-time visual instructions with market impact. Unlike others, our unmatched public record goes back to 1989, discussing how to invest successfully in leading companies since IPO.