Autonomous Trading Financial Report Sales Reach $145 Million in 2019

This article discusses Intuitive Code division, autonomous trading, financial report for 2019 exhibiting $145 million in total sales excluding an extraordinary item in the amount of $1 billion dollars.

This article discusses Intuitive Code division, autonomous trading, financial report for 2019 exhibiting $145 million in total sales excluding an extraordinary item in the amount of $1 billion dollars.

I believe in transparency. What I surely don't believe is in professional scammers located in the good old USA using the same fraudulent practices for decades while troglodytes continue falling for them.

Let me remind that we published over 65,000 case studies since 1989.

Others have nothing to show other than fancy websites, 80% of their personnel working in sales, they are recurrently charged with fraud, but also involved in scandals, hedge funds closing monthly, and trading departments being shutdown for good.

I have no issues whatsoever in showing the actual financial numbers. Actually, it might help you comprehending why we have been the only team of Shopify investors since $19 continuously trying to help others to see the light at the end of the tunnel.

Why do you think Shopify is today a $1,000 stock? We have always known the future.

Now, for your information, our main source of income, in percentage terms 98%, results from our own investments, and not from sales.

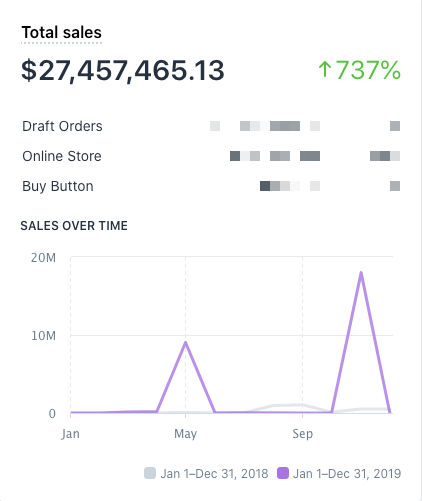

Moving forward, autonomous trading total revenue for 2019 is $145 million excluding

- Intuitive Code revenue

- Offline revenue representing more than 70% of the total amount.

- An extraordinary item in the amount of $1 billion addressed on the news in 2019

So, the amount of online sales on this site is a fraction of the total amount. This fraction is $27.5 million from sales on this site only.

Kindly note that, small investors represent a negligible fraction of total revenue. To keep it simple, I maintain "selling" to small investors because Alex asked me to. It was part of the our arrangement, otherwise, I would had closed it the very first thing in the morning.

I may take thirty times longer trying to explain a $3,000 item to a troglodyte which is fully described on the site than selling $1 million taking approximately 1-minute on the same site. The only difference is literally who is placing the order.

The picture, actual Shopify data, shows the average order is roughly $131,000

Why do you see periods of what it appears to be "slowing" sales? It is easy to figure it out, visiting the site, you note several products sold out for a significant period of time. For example, two months ago, a customer purchased over 2,000 licenses of a new product immediately changing its status on the site.

We run different blogs and sites, therein you find

- hundreds of certified reviews, not fake ones as over 90% use

- interviews

- actual brokerage statements

Now, let me ask you. What the hell others show you?

When Alex refers to competitors as merely a scam, he is not just referring to their lousy work and track record. They are actually a scam hiring criminals as employees, fraud accounting, fake marketing, all of it.

My personal experience since the acquisition of the unit is that there is a lot of confusion, but Intuitive Code is not Autonomous Trading, and vice-versa. Learn about us