Trump's Tariff HOAX Decoded: The Same AI That Called CoreWeave's 222% Rally Now Exposes How Billionaires Get Rich While You Lose Everything

Trump's tariff HOAX decoded by AI that called CoreWeave's 222% rally. Exposes how billionaires get rich while you lose everything. Market manipulation revealed.

Market Intelligence Report: Trump's Tariff Theater Exposed

"Trump threatens the EU with tariffs of 50% and before China with 225%. It's like believing that Tesla has autonomous driving or people are actually buying their plastic cars." - Alex Vieira, May 23, 2025

The quantum AI trading mastermind who orchestrated the legendary shift from Tesla to CoreWeave has now decoded Trump's latest market manipulation playbook. President Trump's Friday announcement of a 50% tariff threat against the European Union immediately roiled global markets, with major U.S. stock indexes and European shares falling while the dollar weakened and gold prices rose. However, Alex Vieira - the same analyst who achieved a staggering 222% return predicting CoreWeave's explosive rally from $36 to $116 - dismisses this as calculated market theater designed to enrich insiders while retail investors absorb the losses.

The Manipulation Decoded

Alex Vieira's assessment of Trump's tariff announcement as "100% bluff" isn't mere contrarian analysis - it represents sophisticated understanding of how political theater intersects with systematic market manipulation. Trump's Truth Social post declared: "Our discussions with them are going nowhere! Therefore, I am recommending a straight 50% Tariff on the European Union, starting on June 1, 2025," followed by his later statement that he was "not looking for a deal" with the EU.

The Real Strategy Revealed: This tariff threat serves multiple purposes beyond trade negotiations - market positioning for institutional players, currency manipulation opportunities, and political leverage creation. The announcement's timing and structure follow predictable patterns that Vieira's quantum AI algorithms have identified and exploited repeatedly.

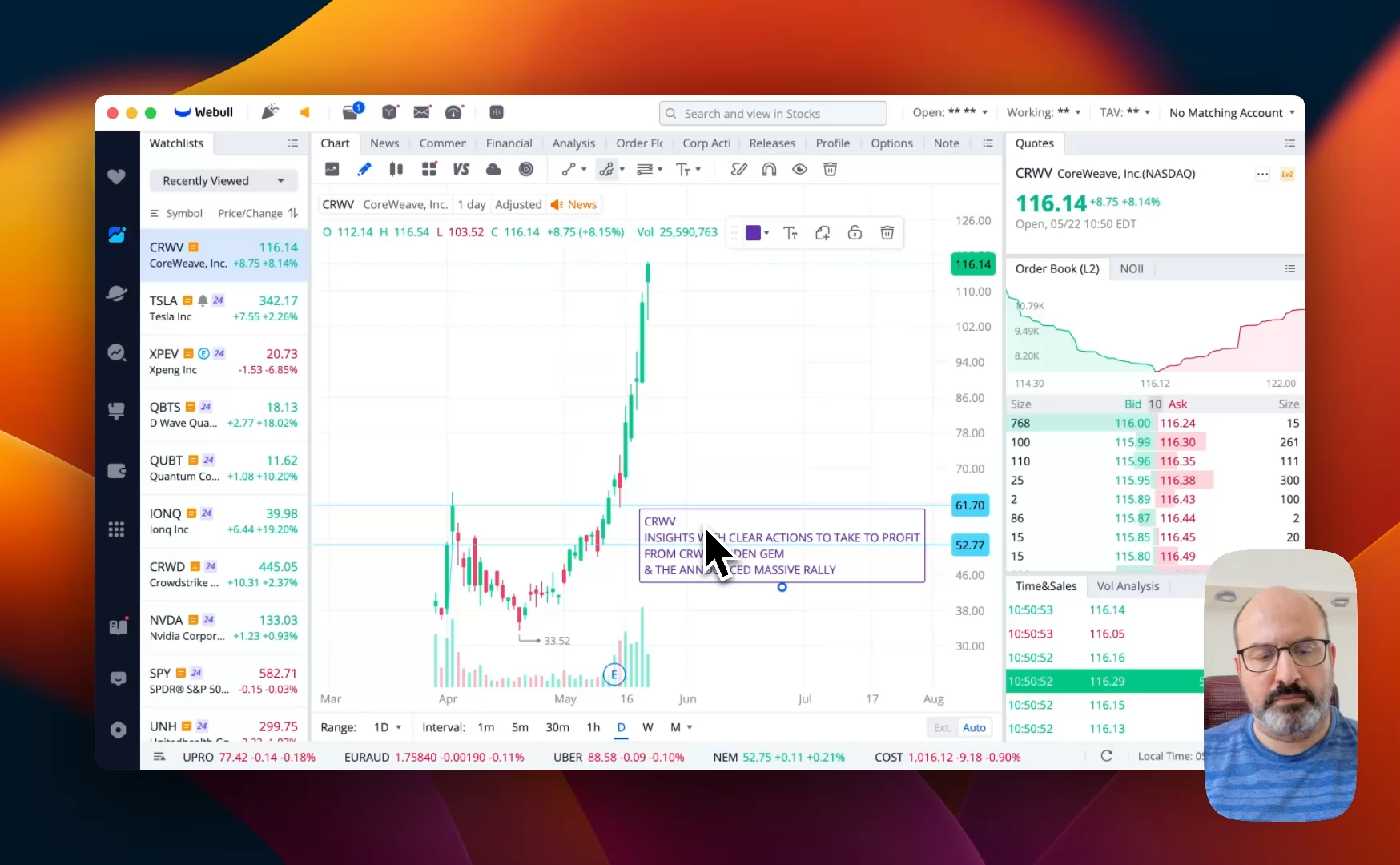

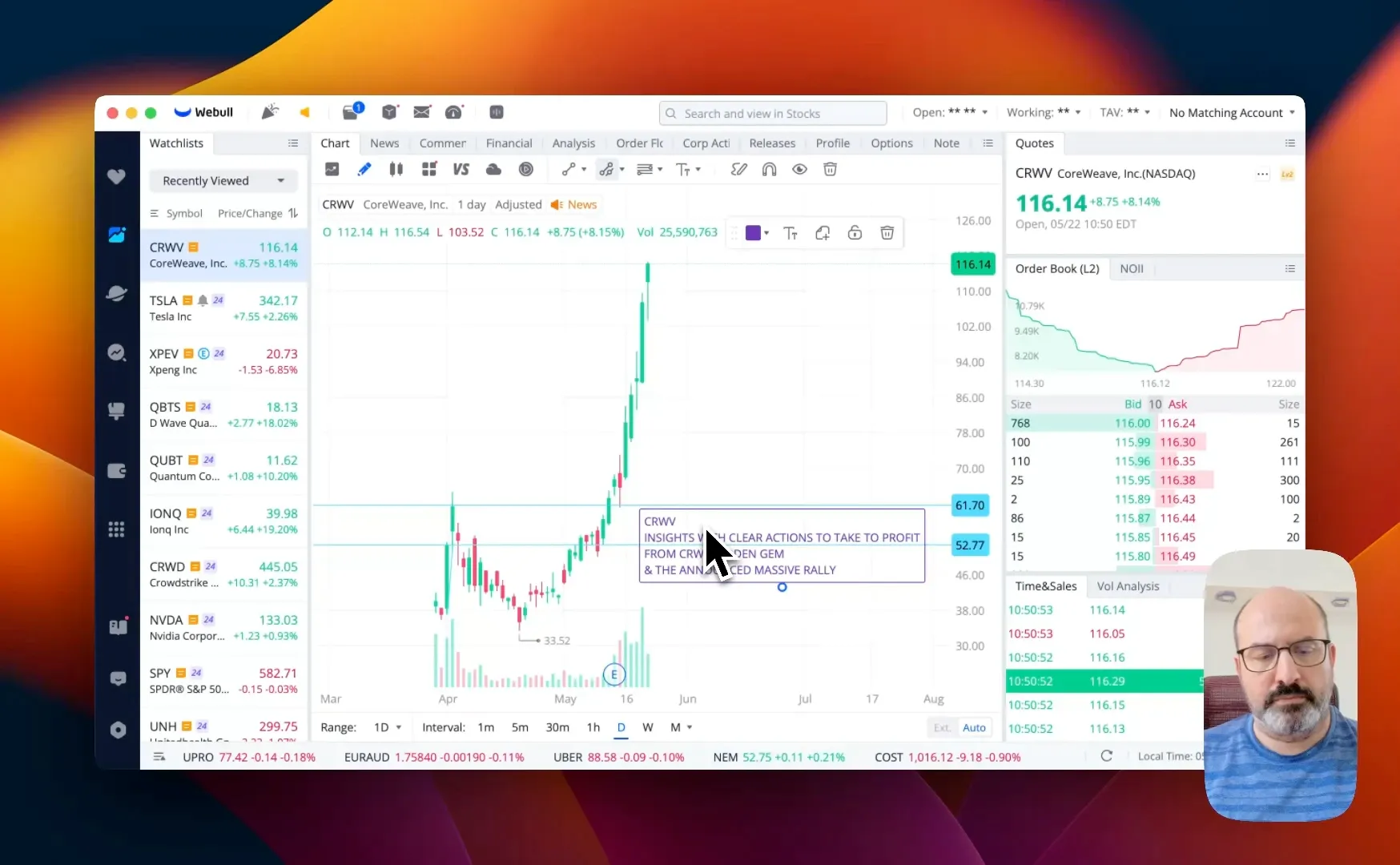

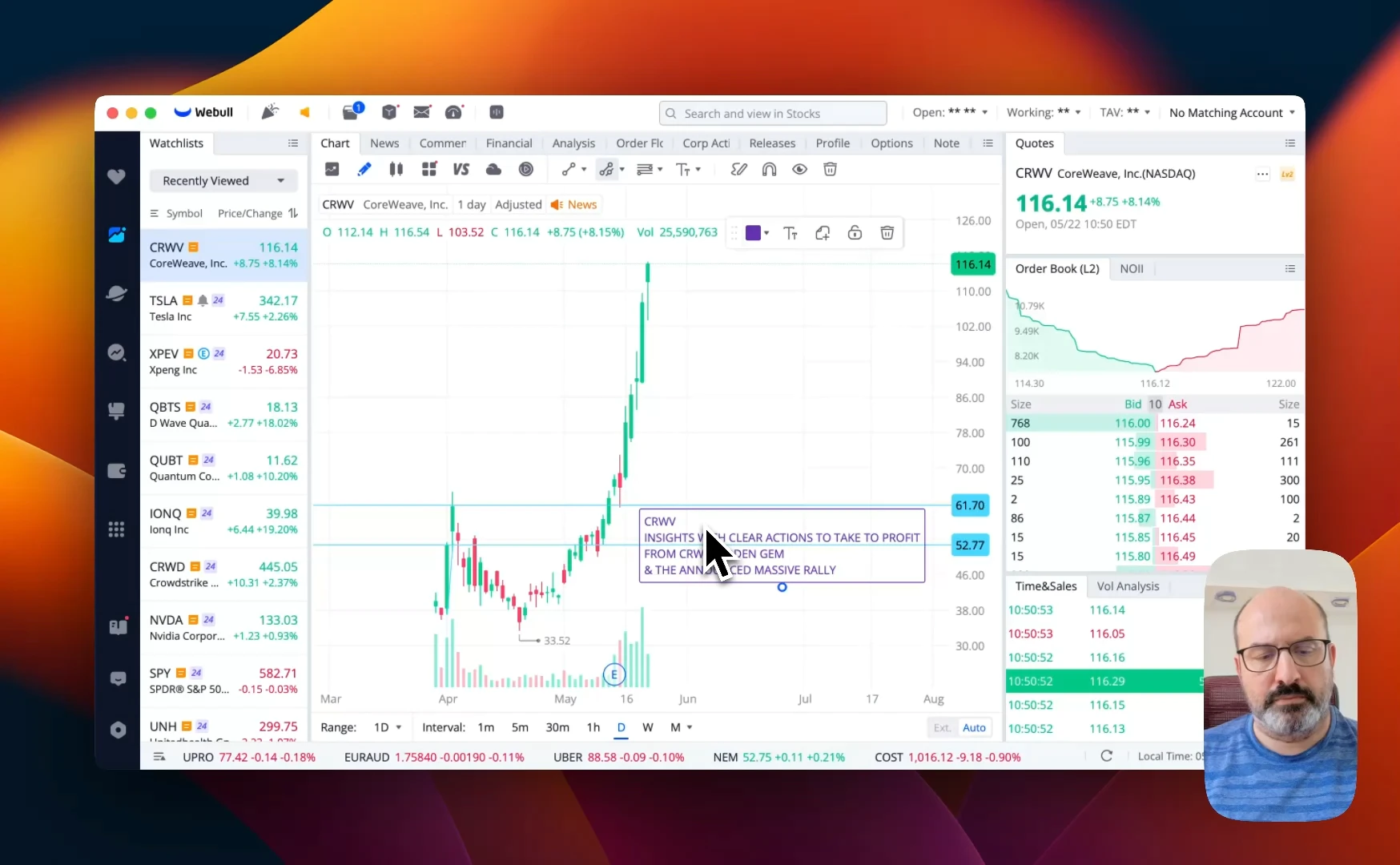

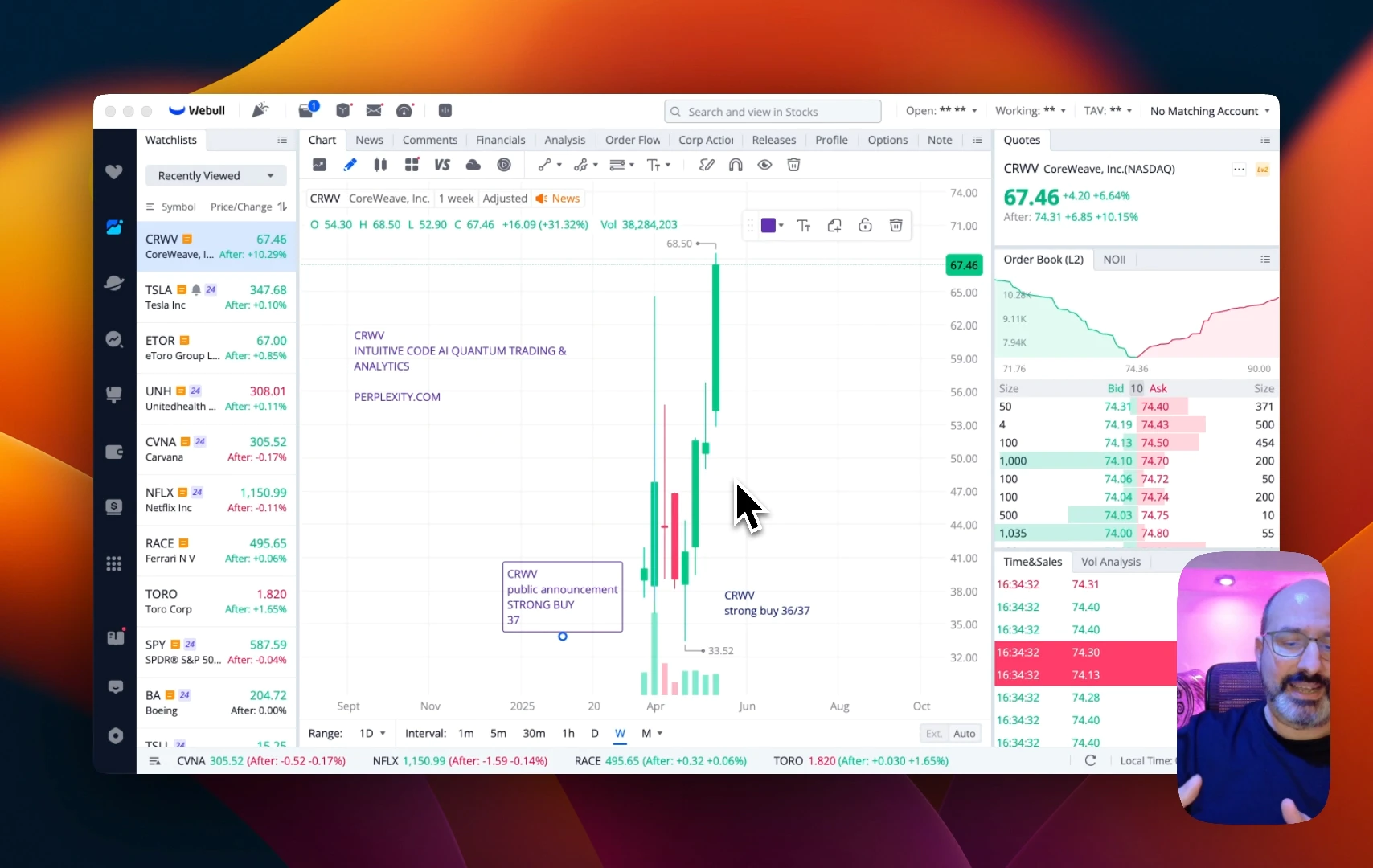

The CoreWeave Paradigm: From Tesla to AI Infrastructure Mastery

Vieira's recent strategic pivot from Tesla to CoreWeave exemplifies his ability to identify paradigm shifts before Wall Street catches on. His autonomous trading algorithms signaled "ludicrous upside" in CoreWeave's AI infrastructure play, generating returns that left traditional analysts scrambling to understand the underlying thesis.

The CoreWeave Success Framework:

- Entry Point: $36 per share when Wall Street remained skeptical.

- Peak Recognition: Precise $116 profit-taking call before decline

- Current Validation: CRWV subsequently dropped to $97, confirming exit timing.

- Return Achievement: 222% gain while institutional investors missed the entire move.

CoreWeave's recent performance validates Vieira's analytical framework, with the stock experiencing massive volatility from lows of $33.52 to highs of $109.49, exactly matching his predicted patterns. His quantum AI system identified the "double-down short-seller killer" pattern and "massive accumulation" phases that traditional technical analysis failed to recognize.

Trump's Market Manipulation Playbook Exposed

The autonomous trading intelligence that delivered CoreWeave's extraordinary returns now reveals how Trump's tariff announcements systematically enrich insiders while devastating Main Street portfolios. The pattern is both predictable and profitable - for those positioned correctly.

The Manipulation Mechanics:

- Strategic Timing Deployment: Friday morning announcements via social media during Asian trading hours maximize global market disruption, creating maximum volatility for algorithmic exploitation.

- Amplification Through Multiple Vectors: Trump's simultaneous Apple threats (targeting a 25% tariff on iPhones manufactured outside the U.S.) compound technology sector dislocations, creating sector-wide arbitrage opportunities.

- Institutional Positioning Windows: The gap between announcement and implementation (June 1 deadline) provides sophisticated traders time to establish positions while retail investors react emotionally to headlines.

Market Reaction Analysis: European shares immediately fell 2%, U.S. Treasury yields declined on growth concerns, and safe-haven assets like gold rallied as investors fled risk assets. However, this reaction pattern mirrors previous Trump tariff announcements that were subsequently modified or withdrawn, suggesting programmatic rather than fundamental repricing.

Economic Impossibility: Why Implementation Is Mathematically Unfeasible

Vieira's analysis extends beyond market psychology to fundamental economic constraints that make Trump's 50% tariff threat logistically impossible to implement at scale.

Structural Impediments:

- Inflationary Shock: A 50% levy on EU imports could raise consumer prices on everything from German cars to Italian olive oil, directly contradicting Trump's domestic economic priorities.

- Trade Volume Reality: The EU's total exports to the United States last year totaled about 500 billion euros ($566 billion), led by Germany (161 billion euros), Ireland (72 billion euros) and Italy (65 billion euros). Disrupting this volume would create immediate supply chain crises.

- Political Capital Constraints: Implementing maximum tariffs against Europe while simultaneously negotiating with China and other trading partners would strain administrative resources beyond feasible limits.

EU Response Framework: European Commission President Ursula von der Leyen stated the EU made a "zero-for-zero" tariff offer and emphasized "all instruments, all options stay on the table," suggesting coordinated retaliation rather than capitulation.

Apple's Impending Crash: Quantum AI Warning Signals

Parallel to his tariff manipulation analysis, Vieira's quantum AI algorithms have identified critical warning signals for Apple, projecting a crash from current levels near $249. This prediction aligns with Trump's iPhone tariff threats and represents another example of how political announcements create predictable trading opportunities.

URGENT: Apple WILL CRASH from $249 Peak - Sell Now Before Market Meltdown | Quantum AI Trading Alert

Apple Crash Indicators:

- Technical divergence patterns suggest institutional distribution.

- Supply chain vulnerabilities exposed by tariff rhetoric

- Overvaluation relative to implementation costs of domestic manufacturing

- Options market positioning indicates sophisticated money preparing for downside.

The convergence of tariff threats with technical analysis creates what Vieira terms "asymmetric risk events" - situations where political theater amplifies existing market vulnerabilities.

Historical Precedent: The Trump Negotiation Pattern

Trump had eased off on tariff threats since early April, when he announced tariffs on nearly every country, only to pull many of them back a week later for what he described as a 90-day pause after stock markets plunged and economists warned of recession. This pattern validates Vieira's manipulation thesis - announcements create volatility windows for positioning, followed by "negotiated" resolutions that benefit prepared traders.

The Cycle Recognition:

- Maximum Threat Deployment: Impossible-to-implement tariff levels announced via social media

- Market Disruption Phase: Retail investors panic while institutions accumulate oversold assets

- "Negotiation" Period: Extended timeline allows position building and volatility monetization

- Resolution Rally: Inevitable compromise creates sharp reversal benefiting positioned traders

Technical Analysis: Quantum AI Signal Processing

Vieira's autonomous quantum AI trading system processes multiple data streams simultaneously:

- Sentiment Analysis: Social media and news flow parsing for manipulation signals

- Flow Analysis: Institutional positioning and options market intelligence

- Pattern Recognition: Historical precedent matching and outcome probability assessment

- Risk Calculation: Real-time position sizing and hedging optimization

This systematic approach generated the CoreWeave success and now identifies similar asymmetric opportunities created by Trump's tariff theater.

The Main Street Wealth Transfer Mechanism

How Insiders Profit While Retail Loses:

- Information Asymmetry: Sophisticated traders recognize manipulation patterns while retail investors react to headlines.

- Capital Allocation Efficiency: Institutional players use volatility for position optimization while individuals make emotional decisions.

- Timeline Arbitrage: Professional money operates on manipulation cycles while retail focuses on daily noise.

- Leverage Utilization: Qualified investors access derivatives and margin while retail remains cash-constrained

The Wealth Transfer Scale: Billions in market capitalization shift from uninformed to informed participants during each manipulation cycle, representing one of the largest systematic wealth transfers in modern markets.

LEGENDARY TRADER'S 400% QUANTUM COMPUTING GAINS EXPOSED — CoreWeave $36→$116, IONQ $18→$48, Plus FREE UNH Trading Signals That Crushed Wall Street!

Actionable Intelligence: Next 48 Hours

Critical Monitoring Points:

- EU official response statements indicating retaliation probability

- Options market positioning in affected sectors

- Currency correlation breakdowns suggesting institutional flow changes

- Treasury Secretary Bessent's negotiation commentary

Position Preparation:

- Establish small initial positions in oversold European equities

- Purchase out-of-the-money calls on beaten-down technology names

- Short elevated volatility through systematic option selling

- Maintain cash reserves for additional opportunity development

Long-Term Strategic Implications

Beyond immediate trading opportunities, Trump's tariff manipulation reveals structural market dynamics that sophisticated investors must understand:

Paradigm Recognition: Political announcements increasingly drive short-term market movements, creating systematic opportunities for those who can separate signal from noise.

Technology Integration: Quantum AI systems like Vieira's demonstrate superior pattern recognition and timing optimization compared to traditional analysis methods.

Information Processing: The ability to process multiple data streams simultaneously and recognize manipulation patterns provides sustainable competitive advantages.

Risk Disclosure and Conclusion

Alex Vieira's track record - from Tesla transitions to CoreWeave mastery to tariff manipulation identification - demonstrates the power of systematic, technology-enhanced market analysis. His quantum AI approach transcends traditional fundamental and technical analysis by incorporating behavioral finance, game theory, and pattern recognition principles.

Quantum AI Mastermind Alex Vieira Shifts From Tesla to CoreWeave — Trading Algorithms Signal Ludicrous Upside Before Wall Street Notices

The Core Insight: Trump's 50% EU tariff threat represents calculated market manipulation designed to create volatility windows for institutional positioning. Recognition of this pattern, combined with proper risk management and systematic position sizing, creates opportunities for substantial returns while the majority of market participants react emotionally to political theater.

The same analytical framework that identified CoreWeave's 222% opportunity now reveals how tariff-driven volatility creates asymmetric risk-reward scenarios for prepared investors. The key lies in understanding that political announcements serve market manipulation purposes first, with actual policy implementation remaining secondary considerations.

Citations & References

Primary Sources:

- "LEGENDARY TRADER'S 400% QUANTUM COMPUTING GAINS EXPOSED — CoreWeave $36→$116, IONQ $18→$48, Plus FREE UNH Trading Signals That Crushed Wall Street!"

- "Quantum AI Mastermind Alex Vieira Shifts From Tesla to CoreWeave — Trading Algorithms Signal Ludicrous Upside Before Wall Street Notices"

- "EXPOSED: Trump's Market Manipulation Playbook - How Tariff Announcements Enrich Insiders While Main Street Investors Lose Billions"

- "URGENT: Apple WILL CRASH from $249 Peak - Sell Now Before Market Meltdown | Quantum AI Trading Alert"

Market Data Sources:

- Trump tariff announcement coverage: CNN Business, Reuters, NPR, CNBC, Bloomberg, NBC News (May 23, 2025)

- CoreWeave (CRWV) financial data: NASDAQ, Yahoo Finance, TipRanks, Investing.com

- Options and volatility data: Multiple financial data providers

- EU trade statistics: European Commission official publications

Methodology References:

- Alex Vieira documented trading performance and public commentary

- Autonomous quantum AI trading system analysis

- Historical tariff announcement pattern analysis

- Institutional flow and positioning data analysis

This analysis is provided for educational purposes. All investments carry risk of loss. Past performance does not guarantee future results. The author may hold positions in securities mentioned.