Should You Buy ROKU or Netflix? Investors Ask Autonomous AI

Wall Street is a complicated place where trading decisions are based on human intuition and then enhanced by analytics. We get much better results by relying on highly accurate AI stock analysis. Take the example of ROKU vs. Netflix, which is the object of this article.

Disclosure: I sold my position in ROKU at $489, learning about it from Alex Vieira on the Autonomous Yac app.

Wall Street vs. Autonomous AI

Wall Street is a complicated place where trading decisions are based on human intuition and then enhanced by analytics. While human intuition may be getting better at making trading decisions, it is not always accurate. People can be emotional, and this can affect the quality of their decisions. In the past, the best traders have always been able to make the best trading decisions. But is this still the case? Are humans still the best at making the best trading decisions? Recent advances in artificial intelligence and machine learning have made it possible for computers to make decisions and trade like humans. Computers are fast, can handle a lot of data, and are not bound by emotions. This is why some people are betting against Wall Street. In the past, investors would often rely on a stockbroker to make trades for them, but now they are finding more and more success by using autonomous AI trading algorithms to manage their portfolios.

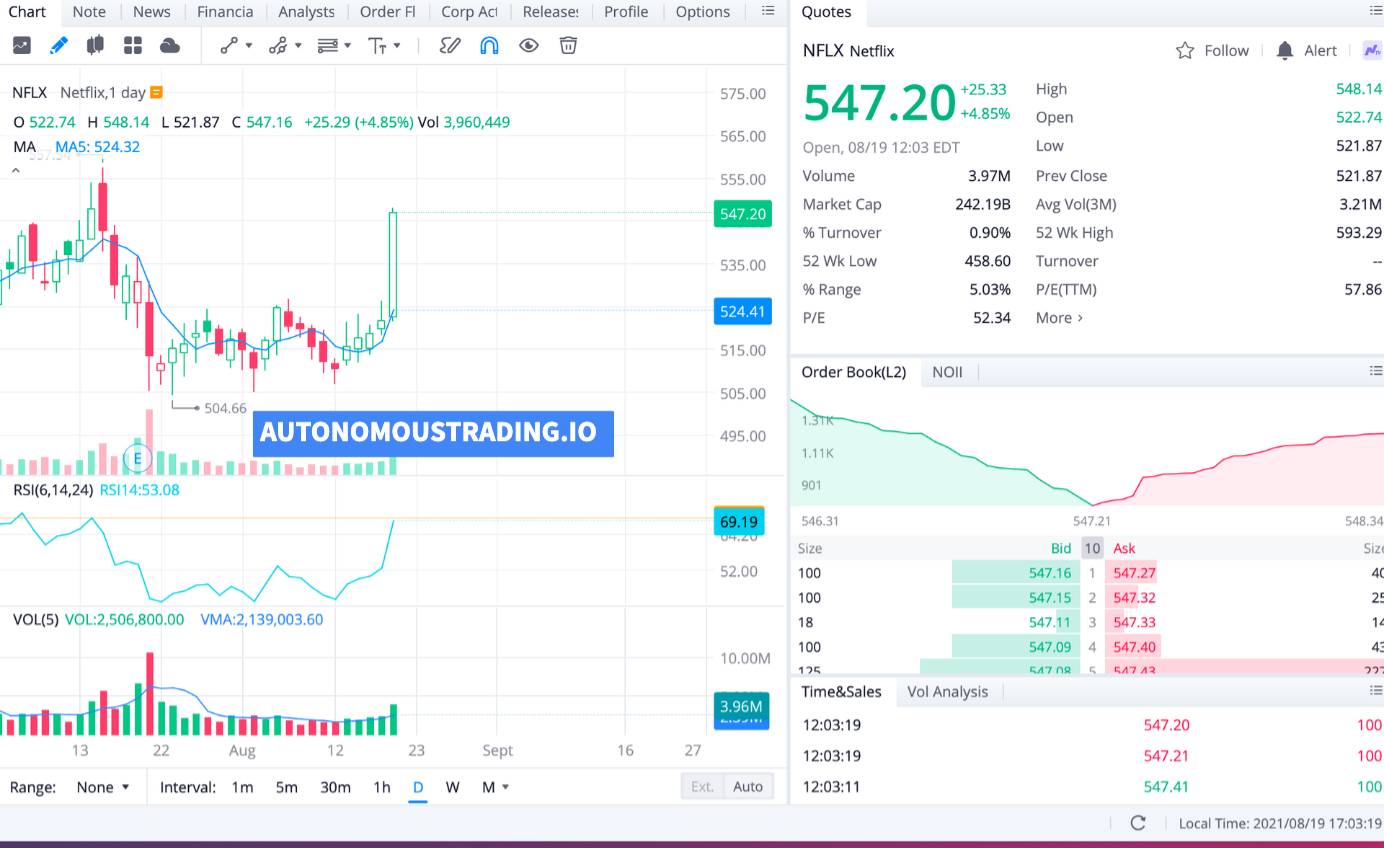

ROKU vs. Netflix

Both are subscription services that allow viewers to stream TV, movies, and original content through the internet, but people are keen to see which is better. Both ROKU and Netflix have a wide selection of content to choose from and both boast their own original content. ROKU has partnerships with several streaming channels, including Amazon, Hulu, and Youtube. On the other hand, Netflix produces its own content and has increased its original programming to include movies and shows that are exclusively made for them. While both are great, ROKU has more content and a wider selection for its viewers.

AI Helps You Outperform Regardless of Market Conditions.

To be successful in the stock market, you have to focus on what's ahead instead of today's action. Autonomous AI algorithms can help you know the future while humans cannot.

I've been using Autonomous AI Trading for a few months now and I've got to say that the service has been a big help in my trading. I've been able to get a lot of information about companies I'm interested in, and I've also been able to perform risk analysis based on the AI's prediction. If you're looking for automated trading, I highly recommend Autonomous AI Trading. Lee Jin

I started buying ROKU at $19 but could not resists selling shares going short. I used my humungous capital to buy more shares of Netflix, which represents better value according to the most recent Autonomous AI Algorithm data.

Autonomous Trading services are entirely free to use and accessible to everyone except a few cases, such as professional services, analysis on-demand, live events for professionals, courses, AI bots, expert support, custom products, AI portfolio, and risk analysis, and services distributed through apps.

Our proprietary AI algorithm picks up the best stocks to buy and best selling-short opportunities delivering the fastest return on investment in the industry.

Let me know where do you prefer to invest, Netflix or Roku. Start your free trial.