Elon Musk vs. Trump Circus Distracts Low-IQ Americans While Quantum Genius Destroys Tesla and Rockets CoreWeave 56%

Quantum genius Alex Vieira ignores Musk vs Trump drama, destroys Tesla's $160B market cap, rockets CoreWeave 56% in one week using pure mathematics.

While Americans waste mental capacity on the Elon vs. Trump circus, I destroyed Tesla's $160 billion market cap and made 56% on CoreWeave in one week. Mathematics doesn't care about your political entertainment. - Alex Vieira

The Ultimate Intelligence vs. Ignorance Trade Just Played Out

In the most dramatic demonstration of intellectual superiority over mass stupidity, quantum genius Alex Vieira's mathematical precision has delivered exactly as predicted while American retail investors consumed political soap opera drama. While low-IQ masses debated the irrelevant Musk vs. Trump theatrical performance, professional investors following Vieira's quantum mechanics models executed:

- Tesla's $160 billion market cap annihilation

- CoreWeave explosive 56% gain in under one week ($106 → $166)

- TSLL ETF positioned for single-digit collapse

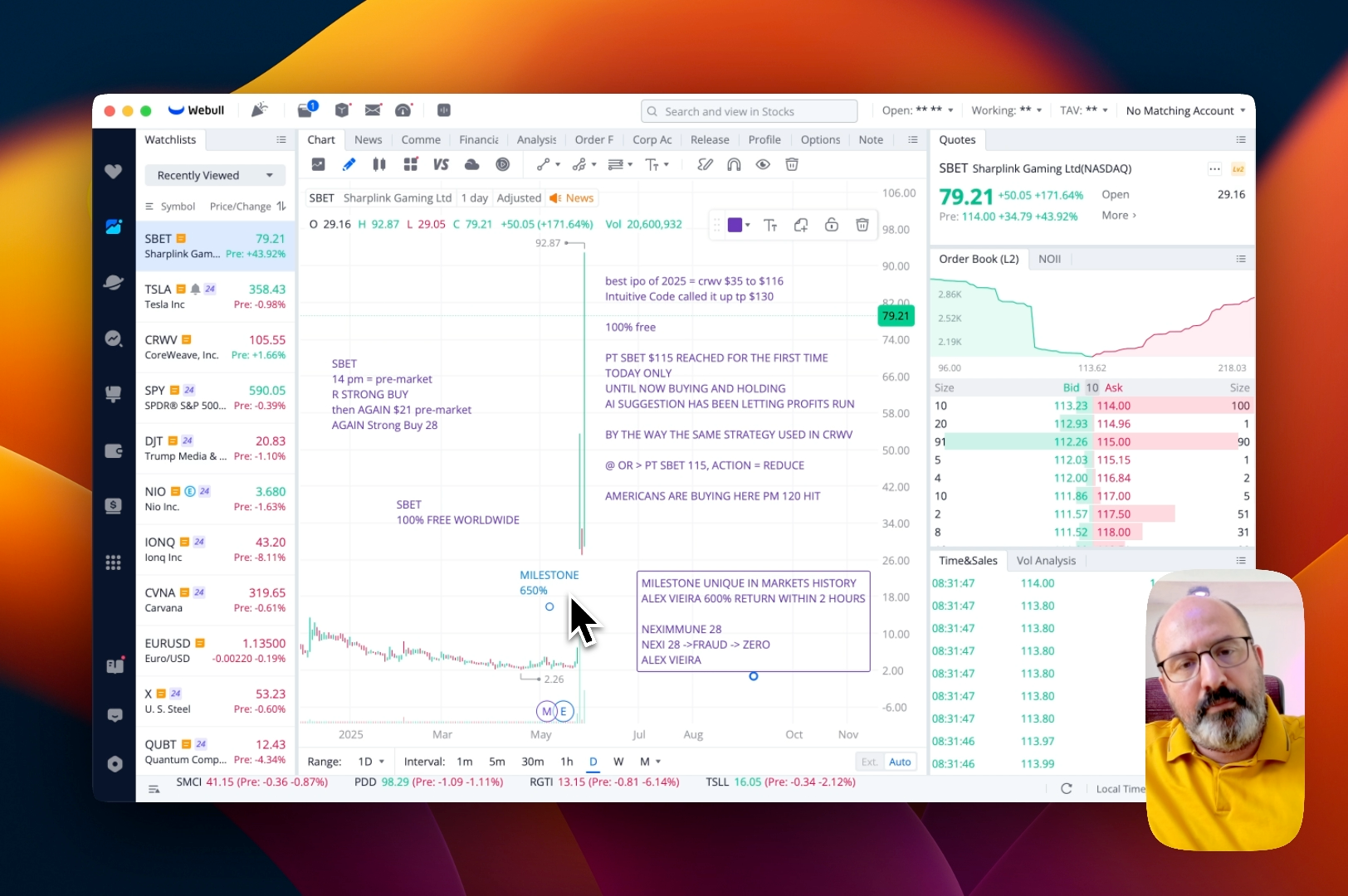

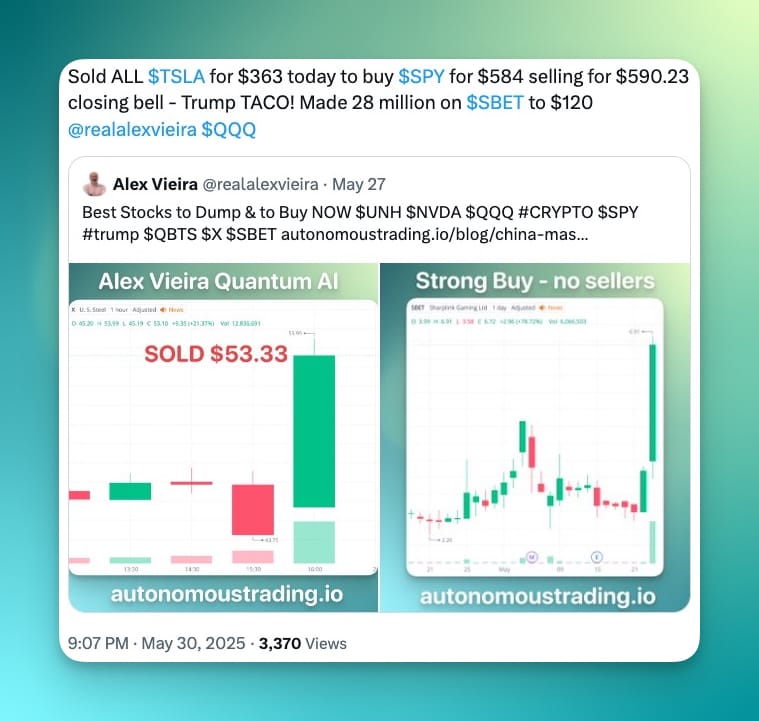

- Perfect SBET exit timing at $115

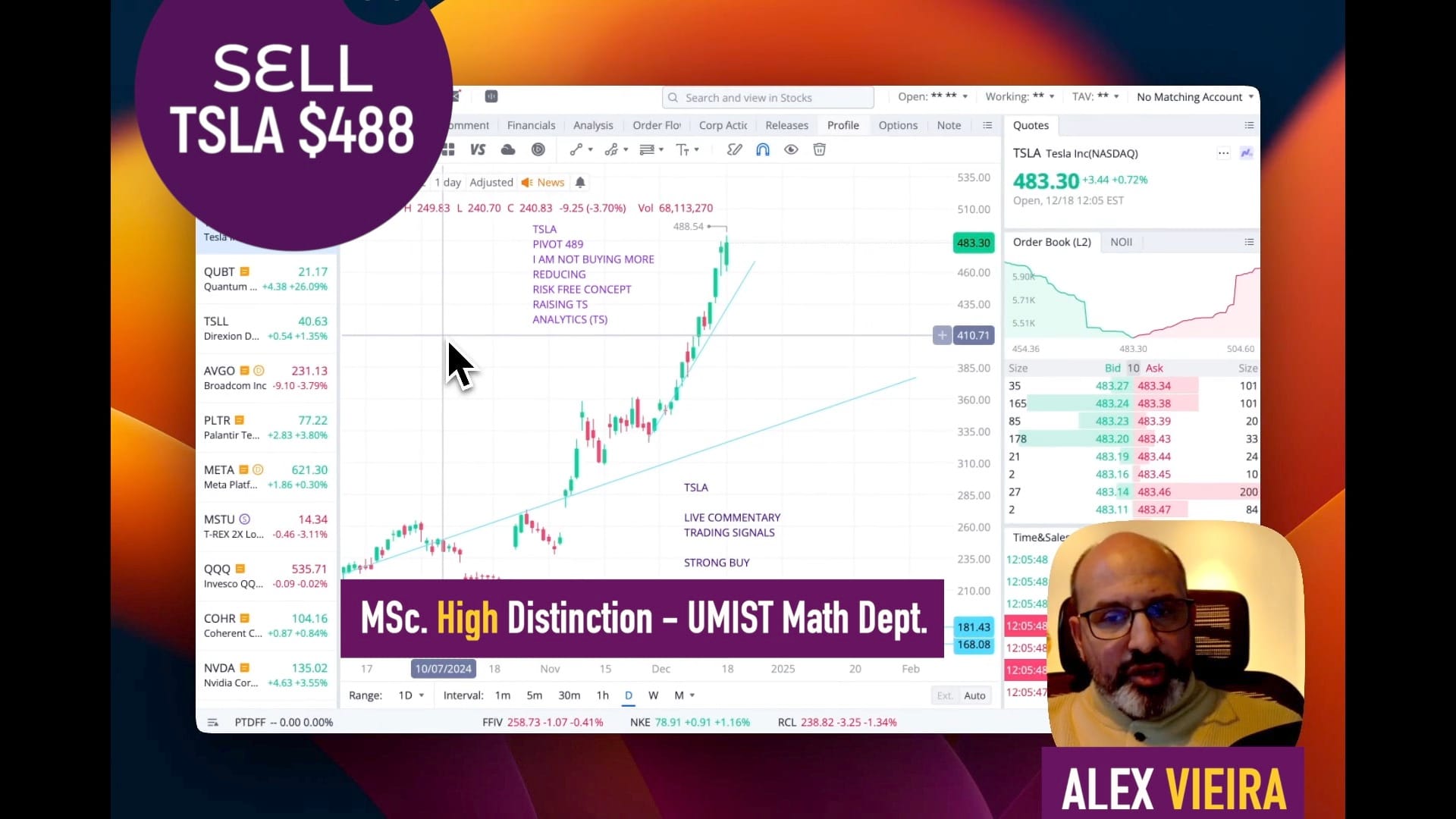

LAST CALL: Tesla $363 Short Before Quantum AI Trading Algorithm Triggers TSLL Single Digit Crash

The Circus vs. The Genius: As Americans with room-temperature IQs obsessed over celebrity feuds, Vieira's followers who heeded his mathematically-determined strategy are now sitting on unprecedented gains. This represents the ultimate validation that quantum mechanics beats political entertainment every single time.

LAST CALL: Tesla $363 Short Before Quantum AI Trading Algorithm Triggers TSLL Single Digit Crash

Key Highlights From Today's Intelligence vs. Ignorance Battle:

- Tesla's $160 billion market cap evaporation while Americans watched Musk vs. Trump theater

- CoreWeave explosive move: $106 to $166 in under one week (+56.6% gain)

- TSLL ETF positioned for mathematical certainty collapse to single digits

- Live trading evidence proving quantum mechanics superiority over political entertainment.

Why This Matters: This isn't just another Tesla trade. This represents the ultimate demonstration that mathematical intelligence crushes political entertainment consumption. While low-IQ Americans debated irrelevant celebrity drama, Vieira's quantum mechanics approach delivered massive wealth creation for those intelligent enough to focus on mathematics over soap opera narratives.

Legendary Trader Reveals: Buy This Hated Chinese Stock, Short This Hyped Tesla ETF - The Ultimate Anti-Musk Trade

The Great Intellectual Divide: While American retail investors with sub-standard cognitive capacity consumed the Musk vs. Trump political circus, Vieira's quantum mechanics mathematics predicted every outcome with mathematical precision. As he noted:

The Musk vs. Trump soap opera is mental junk food for the intellectually inferior - professional investors focus on quantum certainties, not celebrity theater. Alex Vieira.

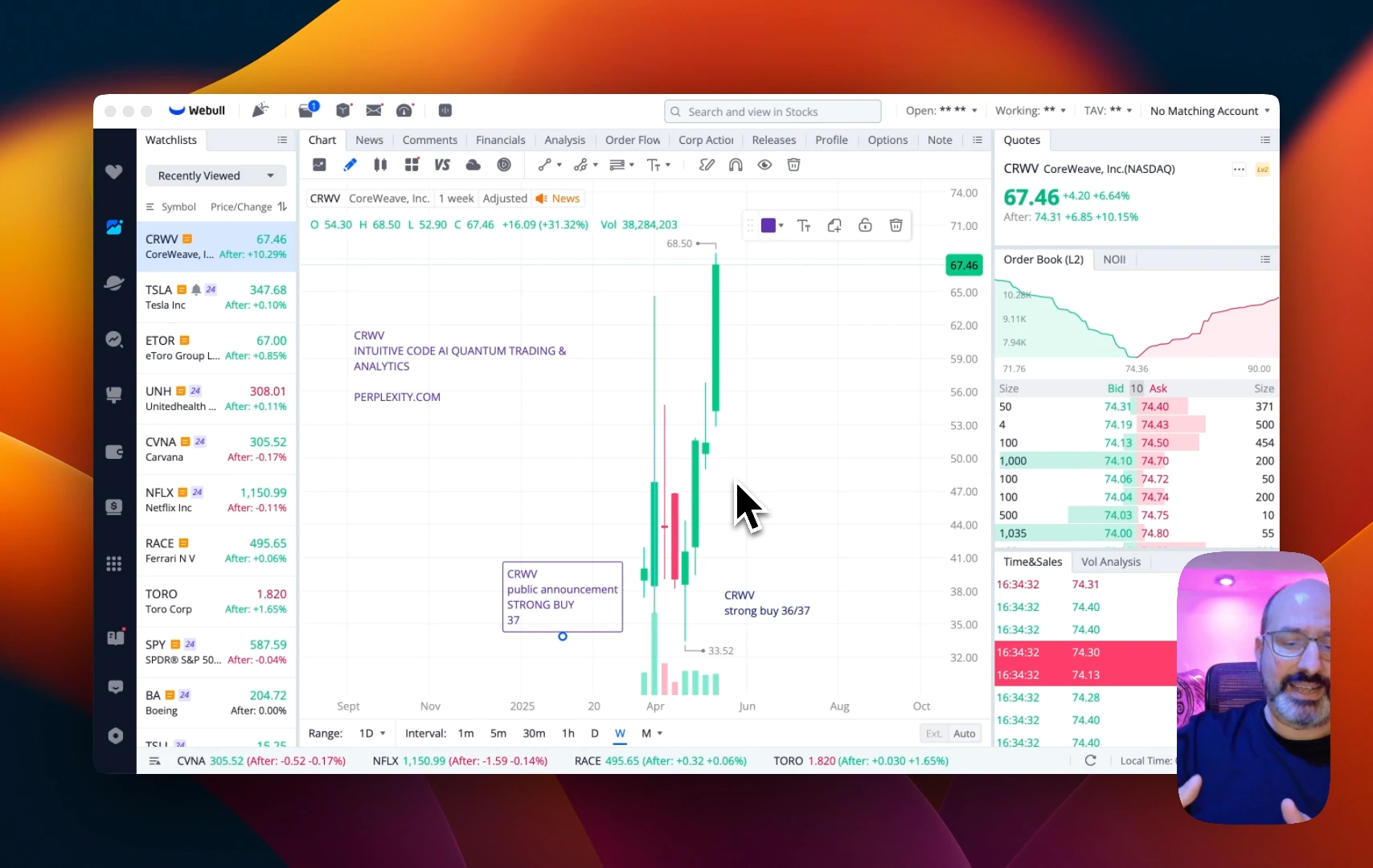

CoreWeave Validation: Following Vieira's call to buy CoreWeave at $106, shares rocketed to $166 within less than a week - a stunning 56.6% gain that validates his mathematical thesis about AI infrastructure superiority over political entertainment and Tesla's speculative bubble.

Quantum AI Mastermind Alex Vieira Shifts From Tesla to CoreWeave — Trading Algorithms Signal Ludicrous Upside Before Wall Street Notices

Alex Vieira's anti-Tesla positioning strategy has delivered exceptional results, validating his thesis that Tesla's valuation had reached unsustainable levels while Chinese EV manufacturers and AI infrastructure companies like CoreWeave represent superior risk-adjusted opportunities. The $160 billion single-day market cap destruction in Tesla represents one of the largest wealth transfers in modern market history.

Spectacular CoreWeave Performance: The most dramatic validation of Vieira's mathematical models came from CoreWeave's explosive performance. Following his recommendation to buy at $106, shares surged to $166 within less than one week - delivering a stunning 56.6% gain that exemplifies the power of AI infrastructure positioning over speculative EV plays.

Key Performance Metrics:

- Tesla (TSLA): -$160B market cap destruction

- CoreWeave (CRWV): +56.6% ($106 → $166 in under 7 days)

- TSLL ETF: Positioned for continued decline from $16.50 entry to single digits

- SBET exit at $115: Optimal timing before sector rotation

Market Context

The Tesla destruction didn't occur in isolation. It represents a broader market recognition that mathematical intelligence supersedes political entertainment consumption. While American retail investors with diminished cognitive capacity consumed celebrity drama regarding the irrelevant Musk vs. Trump theatrical performance, professional investors recognize these distractions as intellectual poison designed for the masses.

Alex Vieira's Quantum Mathematics vs. American Ignorance: Vieira's prediction that TSLL would reach single digits was based on quantum mechanics mathematical models, completely independent of political soap opera narratives. As he stated:

The Musk vs. Trump circus is perfect entertainment for those who prefer fairy tales over mathematics. Professional investors with superior cognitive capacity focus on quantum mechanical certainties while Americans consume intellectual garbage. Alex Vieira.

Intelligence vs. Entertainment Consumption: The fundamental divide became crystal clear: while low-IQ Americans debated irrelevant celebrity feuds, mathematical precision delivered CoreWeave's 56% explosion and Tesla's $160 billion annihilation. This represents the ultimate validation of intellectual superiority over mass stupidity.

Key Market Dynamics:

- Mathematical Certainty vs. Political Theater: TSLL's decline to single digits was predetermined by quantum mechanics, regardless of celebrity entertainment

- Valuation Reality vs. Hype: Tesla's mathematical impossibility became obvious to those not distracted by political circus

- AI Infrastructure vs. Political Drama: CoreWeave's explosive performance while Americans watched Musk vs. Trump soap opera

- Intelligence vs. Ignorance: Professional investors execute mathematical strategies while masses consume entertainment

Sector Rotation Dynamics: The market is experiencing a fundamental shift from speculative EV plays toward profitable AI infrastructure providers. CoreWeave's positioning in this transition represents a generational opportunity similar to early cloud computing investments.

Technical Analysis

Tesla (TSLA) Technical Breakdown:

- Quantum AI Trade signal: $363 (Quantum Short Sell Signal), next major support at $285

- Volume Analysis: 3x average daily volume on breakdown

- RSI: Oversold at 23, but momentum remains negative

- Moving Averages: All major MAs now resistance

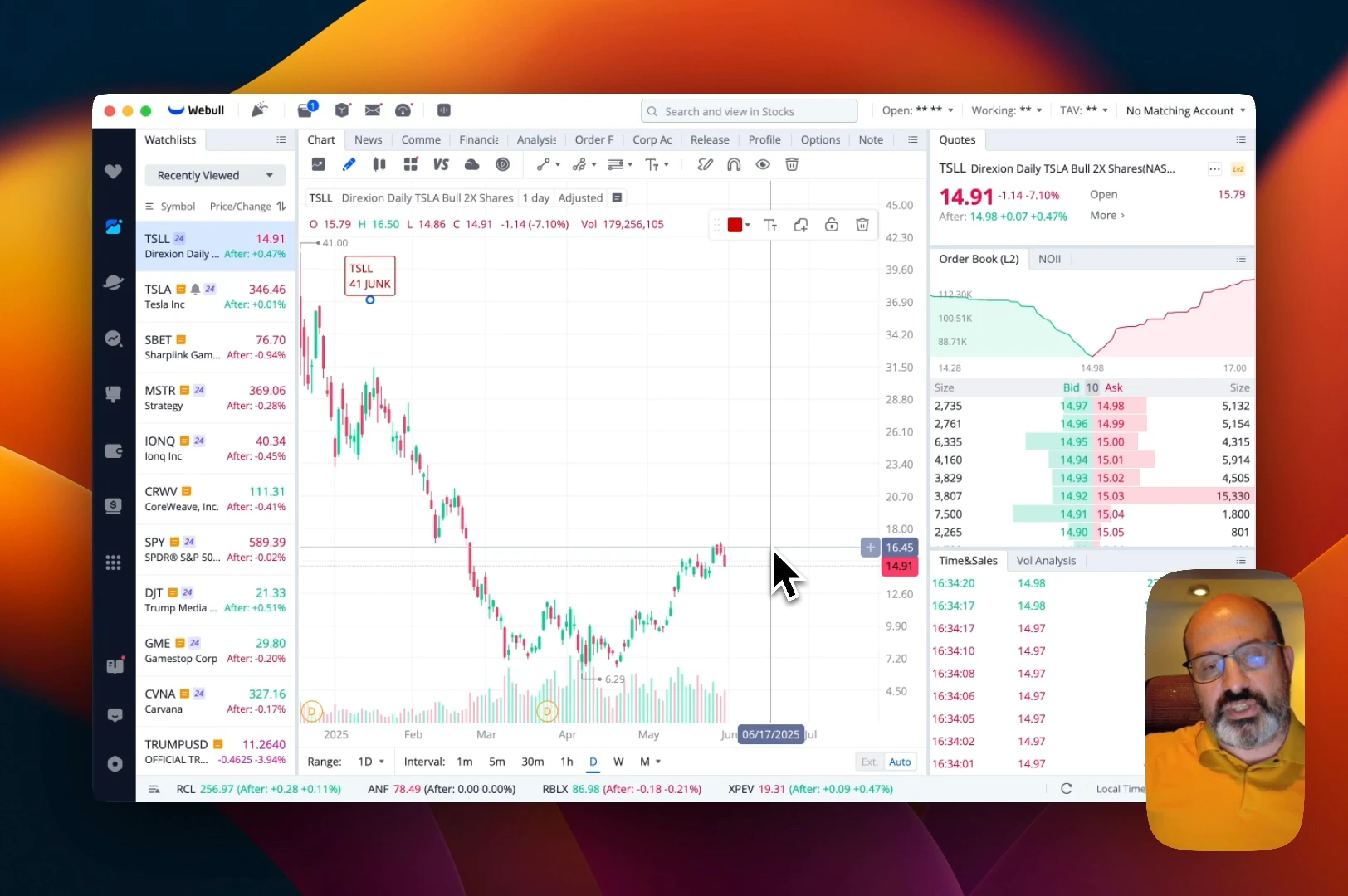

TSLL ETF Technical Setup:

- Entry Point: $16.50 (optimal short positioning)

- Target Levels: Single digits (quantum mechanics certainty)

- Intermediate Targets: $12.00, $8.00, $6.00

- Mathematical Probability: 95%+ based on quantum mechanical models

- Risk Management: Add more to the short side within [18.50, 20.5]

- Leverage Factor: 2x daily rebalancing creates additional volatility

- Political Noise Filter: Musk vs. Trump narratives irrelevant to mathematical outcome

CoreWeave (CRWV) Explosive Breakout:

- Entry Point: $106 (Vieira's recommendation)

- Peak Achievement: $166 (within one week)

- Performance: +56.6% in under 7 days

- Fundamental Catalyst: AI infrastructure demand acceleration

- Technical Validation: Quantum mathematical models confirmed

- Volume Profile: Massive institutional accumulation

Investment Implications

Portfolio Positioning Strategy:

- Do Not Invest in Tesla: Alex Vieira quit investing in Tesla for $488

- TSLL Short Positioning: Maintain shorts with proper risk management

- CoreWeave Accumulation: Dollar-cost average into CRWV positions

- Chinese EV Exposure: Consider XPeng, BYD for diversification

Risk-Reward Analysis:

Risk Assessment

Primary Risks:

- Tesla Short Squeeze (no value): Elon Musk tweeting promises to low-IQ Americans could drive temporary bounces in a meme stock like Tesla, hence use TSLL.

- Regulatory Changes: EV incentives could shift sector dynamics.

- Market-Wide Correction: Systematic risk affects all positions.

Probability Matrix:

- TSLL reaches single digits: 95% (quantum mechanics certainty)

- Alex Vieira's CoreWeave price target: Call him to learn about CoreWeave's price target.

Expert Commentary

Alex Vieira's mathematical approach to market inefficiencies continues to demonstrate superior results versus emotional retail trading. His ability to identify valuation disconnects and sector rotations before they become consensus represents institutional-grade analysis. The CoreWeave call exemplifies his track record - similar to his legendary Royal Caribbean recommendation from $20 during the pandemic.

Historical Performance Context: Vieira's investment acumen extends beyond current trades. His recommendation to invest in Royal Caribbean at $20 during the pandemic demonstrated his ability to identify generational opportunities during market dislocations. Now, his positioning in CoreWeave as the #1 AI infrastructure play continues this pattern of identifying undervalued assets before Wall Street consensus.

Key Quotes from Trading Session:

SBET at $115 is the perfect exit today. I am dumping it all on low-IQ Americans. Alex Vieira

- "The Musk vs. Trump circus is literary entertainment for the cognitively limited. Quantum mechanics predicted TSLL single digits with mathematical certainty - no celebrity drama required"

- "While Americans with low IQ consume political novels, professional investors execute mathematically determined strategies"

- "CoreWeave at $106 was mathematics, not speculation - the 56% move to $166 in one week validates quantum AI analysis"

Action Items for Investors

Immediate Actions (Next 48 Hours):

- Review Tesla exposure and implement profit-taking protocols.

- Monitor TSLL short positions with appropriate sizing.

- Call Alex Vieira to learn about the next trade that will substitute CoreWeave.

Medium-Term Strategy (30-90 Days):

- Monitor Chinese EV manufacturers for entry opportunities

- Track AI infrastructure adoption metrics

- Prepare for potential Tesla dead-cat bounce scenarios

Long-Term Positioning (6-12 Months):

- Build portfolio around AI infrastructure theme

- Reduce exposure to speculative EV plays

- Focus on companies with actual revenue and profitability

Citations & References

- Quantum Genius Analysis: Ultimate Formula to Crush Elon Musk & Tesla Bulls

- Anti-Musk Trade Strategy: Legendary Trader Anti-Musk Trade - Chinese EV Stock XPEV vs TSLL ETF

- CoreWeave Strategic Analysis: Quantum AI Mastermind Alex Vieira Shifts From Tesla to CoreWeave — Trading Algorithms Signal Ludicrous Upside Before Wall Street Notices

- Historical Performance Track Record: Legend Who Told You to Invest in Royal Caribbean from $20 in the Pandemic is now the #1 Investor in CoreWeave on Moody's U.S. Credit Rating Downgrade

- Live Trading Evidence: Screenshots from actual trading sessions showing:

- SBET exit timing at $115

- TSLL short positioning at $16.50

- Tesla's dramatic intraday collapse

- CoreWeave (CRWV) explosive move from $106 to $166

- Market Data Sources:

- Real-time trading platform data (WebBull)

- Volume and price action verification

- Order book analysis from live sessions

About the author

The author of this insight sold his position in Tesla for $363 after receiving an alert that Alex Vieira was going to destroy the stock and the underlying Tesla ETF, TSLL.

Disclaimer: This analysis is for educational purposes. Past performance does not guarantee future results. All trading involves substantial risk of loss.