Betting Against Wall Street: How Autonomous AI Trading Consistently Beats Professionals: Trading Ideas and Philosophy Investing in Foot Locker

Wall Street is a complicated place where trading decisions are based on human intuition and then enhanced by analytics. We get much better results by relying on highly accurate AI stock analysis. Take the example of Foot Locker which share price soared over 300% on an AI trading signal.

Wall Street is a complicated place where trading decisions are based on human intuition and then enhanced by analytics. We get much better results by relying on highly accurate AI stock analysis. Take the example of Foot Locker which share price soared over 300% on an AI trading signal.

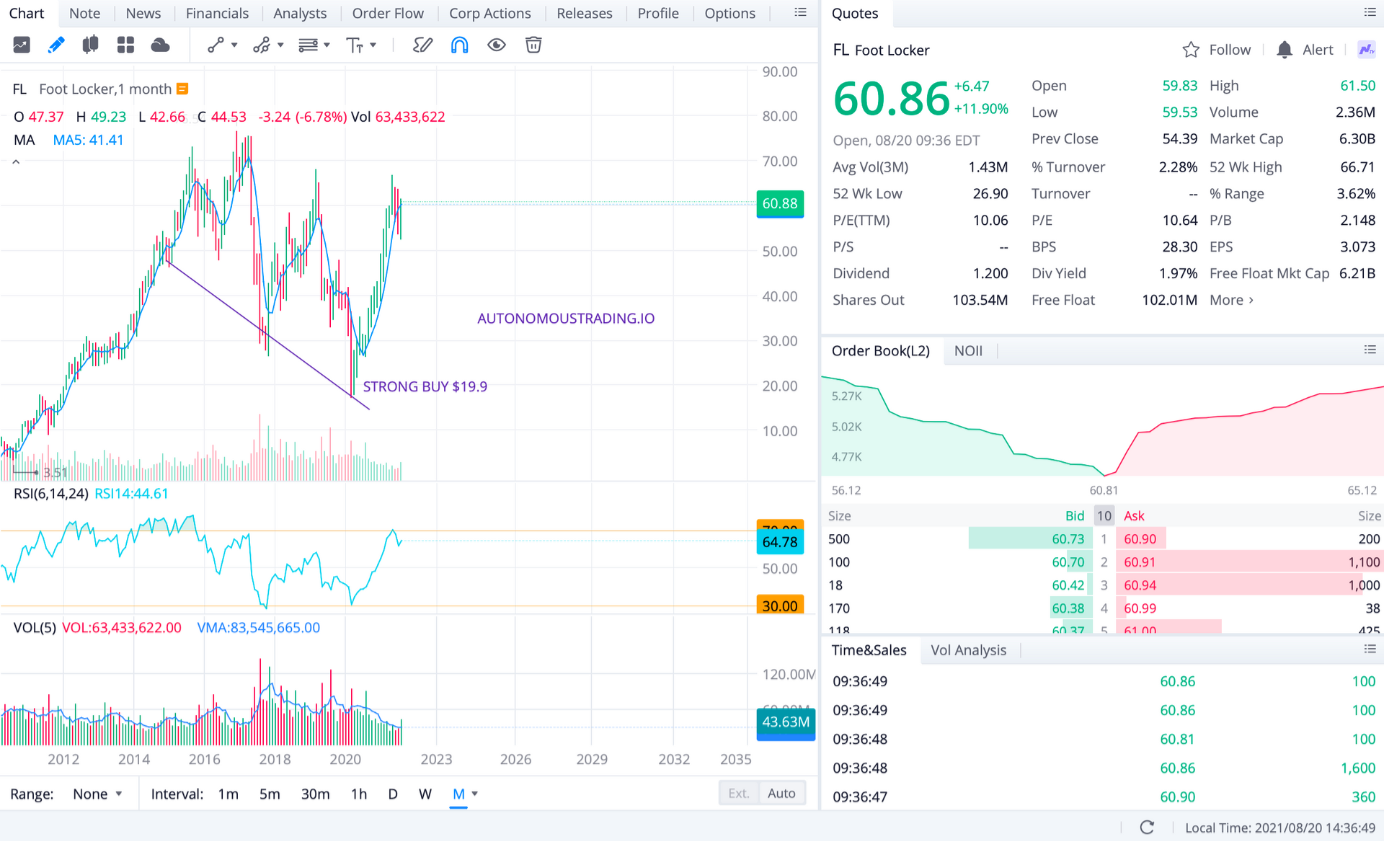

Disclosure: I started investing in Foot Locker at $18.6 using autonomous AI algorithm data.

Wall Street is a complicated place where trading decisions are based on human intuition and then enhanced by analytics. While human intuition may be getting better at making trading decisions, it is not always accurate. People can be emotional, and this can affect the quality of their decisions. In the past, the best traders have always been able to make the best trading decisions. But is this still the case? Are humans still the best at making the best trading decisions? Recent advances in artificial intelligence and machine learning have made it possible for computers to make decisions and trade like humans. Computers are fast, can handle a lot of data, and are not bound by emotions. This is why some people are betting against Wall Street. In the past, investors would often rely on a stockbroker to make trades for them, but now they are finding more and more success by using autonomous AI trading algorithms to manage their portfolios.

AI Helps You Outperform Investing in Foot Locker

I started buying and covering my short position on Foot Locker near $19, knowing that its share price could be worth more than $60 in the future.

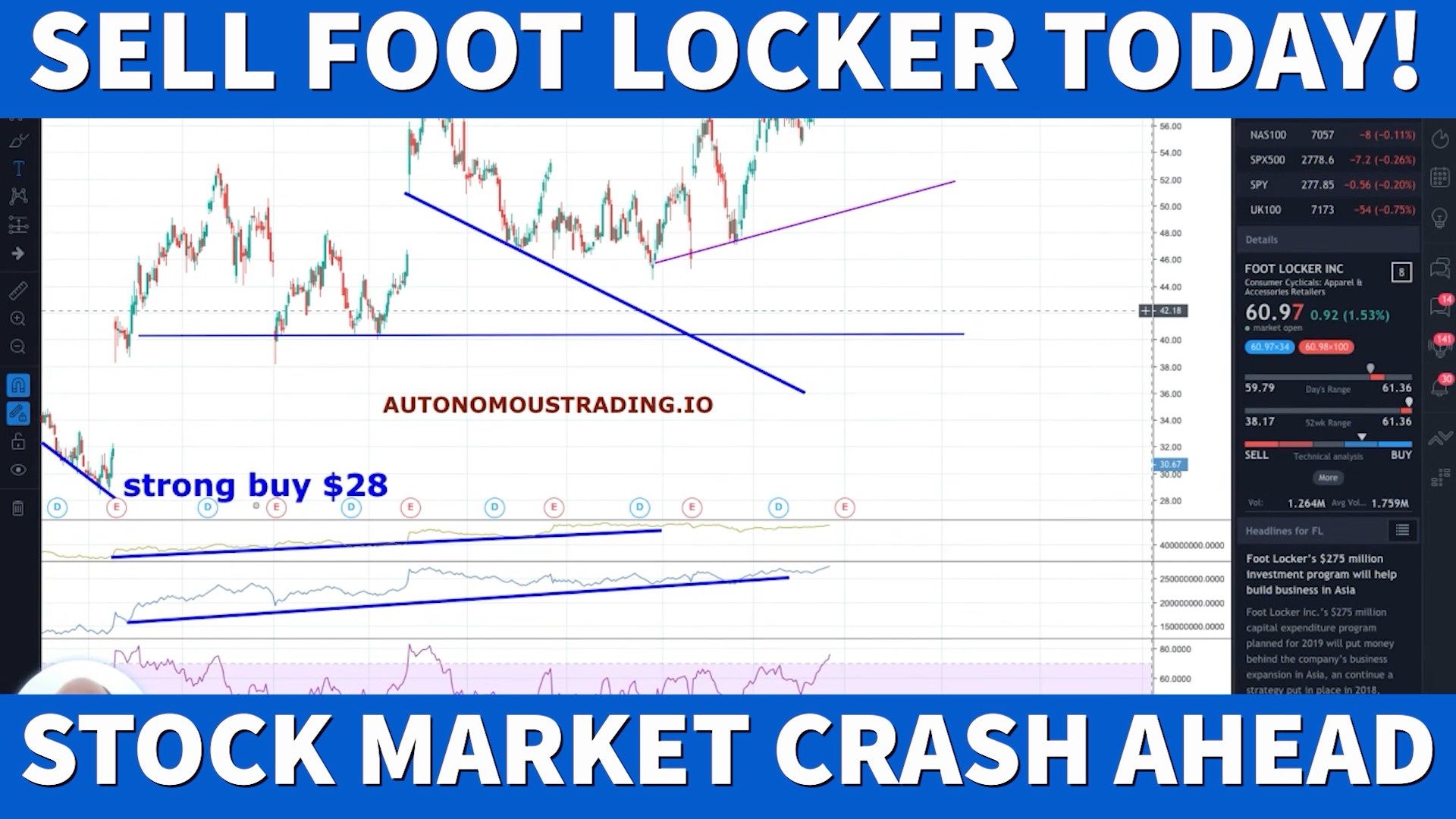

I remind you that I had a short position on Foot Locker ahead of the stock to crash informing you about it.

What's Ahead for Foot Locker vs. Today's Earnings Beat

To be successful in the stock market, you have to focus on what's ahead instead of today's action. Autonomous AI algorithms can help you know the future while humans cannot.

When the American crowd turned bearish stocks, I started investing using highly accurate long-term AI data from autonomous trading. As a result, I believe that you now comprehend why Foot Locker (FL) soared to $61 today.

We have published over 65,000 cases studies since 1989 demonstrating the value of AI. We focus on long-term investment taking advantage of both sides of the market.

Autonomous Trading services are entirely free to use and accessible to everyone except a few cases, such as professional services, analysis on-demand, live events for professionals, courses, AI bots, expert support, custom products, AI portfolio, and risk analysis, and services distributed through apps.

Our proprietary AI algorithm picks up the best stocks to buy and best selling-short opportunities delivering the fastest return on investment in the industry.

Start your free trial.