AI Expert Predicts Shocking Twist in Presidential Race: How the Fed's Secret Strategy Could Topple Trump's Stock Empire

An esteemed AI algorithm analyst suggests that former President Donald Trump should not be concerned about Joe Biden or other Republican adversaries. Instead, it's a formidable market participant determined to do "whatever it takes" to ensure the current president remains in the White House.

An esteemed AI algorithm analyst suggests that former President Donald Trump should not be concerned about Joe Biden or other Republican adversaries. Instead, it's a formidable market participant determined to do "whatever it takes" to ensure the current president remains in the White House.

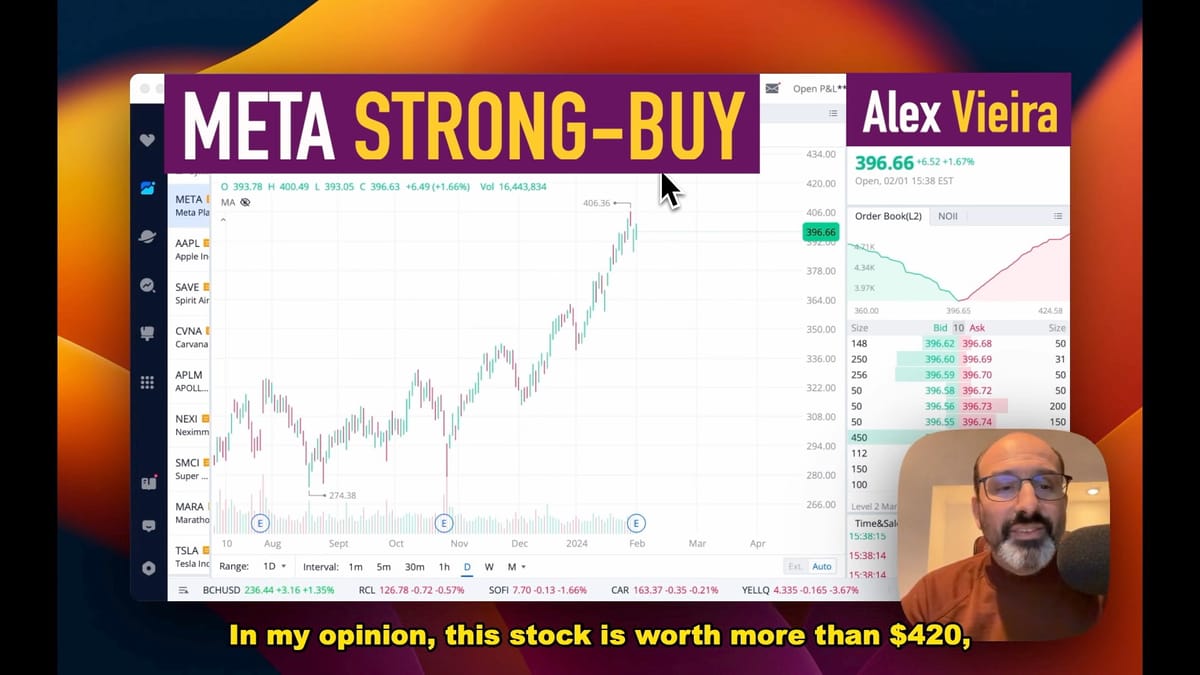

AI analyst Alex Vieira predicts the Fed's market manipulation will impact Trump's DWAC stock, advising a short sell amid political and economic intrigue.

The Enigmatic Influence of the Federal Reserve on Digital World's Fortunes

In a riveting analysis that transcends traditional political rivalries and market dynamics, the spotlight has turned onto an unexpected player who purportedly holds the keys to the upcoming U.S. presidential elections—the Federal Reserve.

According to renowned AI algorithm analyst Alex Vieira, the real contender that former President Donald Trump needs to be wary of isn't Joe Biden or any of his Republican adversaries. Instead, it's a formidable market participant determined to do "whatever it takes" to ensure the current president remains in the White House.

Exposed: The Billion-Dollar Secret Behind the Fed's Market Manipulation to Secure Biden's Reelection

The Strategic Move Against Digital World

Amid this backdrop, Vieira has made a bold call on Digital World Acquisition Corp. (DWAC), a special purpose acquisition company often associated with Trump. Vieira's analysis led him to advocate for selling and going short on DWAC's stock, pegging it at $46 this week.

DWAC $46+ today! I warned you. Thank you for your money. Biden or Trump, we win all the time. $PDD $SPY $QQQ $AMD $NVDA $DWAC $TSLA #stockmarket $SMCI $MU #bitcoin https://t.co/M8pZoo3aVY

— Alex Vieira (@realalexvieira) March 21, 2024

This advice comes after he had previously predicted what could be described as Trump's best rally for 2024. It's a move that signals a bearish outlook on DWAC's market performance in the short term, attributed to what Vieira perceives as the Federal Reserve's intervention to stifle any further rally of Digital World's share price until the November U.S. elections.

The Billion-Dollar Secret

This situation uncovers what can be termed "The Billion-Dollar Secret Behind the Fed's Market Manipulation." Vieira's perspective suggests a concerted effort by the Federal Reserve to manipulate the market in a way that could potentially favor Biden's re-election. In 2023, Vieira took advantage of this alleged manipulation, closing his short position in Digital World at $14.3. This move was shared with the Trump investors' community worldwide, highlighting the depth of his insight into market dynamics and political interplay.

Alex Vieira's Prediction Digital World Stock to Crash Changed the Lives of Many Investors. Slava Ukraini.

A Turnaround in 2024

However, the narrative took a fascinating turn in 2024. Intuitive Code, spearheaded by Vieira, upgraded DWAC's stock to a Strong Buy, aligning it with another notable pick, Super Micro Computer (SMCI).

Quantum Leap AI Unleashed: Alex Vieira's Bold Long Position in SMCI Redefines Stock Market Predictions!

Live AI Trading Market Analysis: Intuitive Code AI Picks SMCI and META as Best Stocks to Buy This Earnings Season

Both recommendations have astonishingly delivered an exact 400% return on investment, underscoring Vieira's prowess as a pioneer in AI-driven solutions for professional investors. Remarkably, SMCI's share price catapulted to $1,200, while DWAC experienced a significant upturn, reaching $58.

AI Genius Alex Vieira Skyrockets Super Micro (SMCI) to New Heights: The $1,089 Stock Prediction Shaking Wall Street!

Investment Insights and Opportunities

Vieira's strategic moves and the subsequent market reactions highlight a complex interplay between market forces, political dynamics, and the unseen hand of regulatory bodies. His track record of precise market predictions and strategic investment recommendations, especially in the volatile and politically charged environment of Digital World, positions him as a formidable figure in the investment community.

For those intrigued by the unfolding drama and the investment potentials it heralds, Intuitive Code offers a gateway to deepen one's market acumen. Their Free Trading Plan is an invaluable resource for novice and seasoned traders. This plan, a testament to Intuitive Code's decade-long commitment to accessible trading solutions, offers a comprehensive package designed to bolster investment decisions with expert knowledge at no cost.

As the political and economic landscapes continue to intertwine, the saga of Digital World, under the shadow of the Federal Reserve's influence, serves as a compelling case study on the power of strategic investment insight in navigating the choppy waters of market speculation and political forecasting.